- Revenue target comfortably exceeded, sharp increase in profitability

- Strong order book ensures good capacity utilisation

- Further growth and further increase in profitability expected in 2019

€ million | FY 2018 | ∆ yoy | Q4 2018 | ∆ yoy |

New orders | 1,952.6 | +25.4% | 403.9 | +5.5% |

Revenue | 1,778.8 | +20.3% | 481.5 | +24.8% |

EBIT (before exceptional items) | 82.0 | +106.5% | 36.1 | +177.7% |

Net income (before exceptional items) | 69.9 | +111.8% | 34.3 | +203.5% |

“2018 was a very successful year for DEUTZ,” says Dr Frank Hiller, Chairman of the Board of Management of DEUTZ AG. “We comfortably exceeded our revenue target and registered a sharp increase in profitability. Our E-DEUTZ strategy is already bearing fruit and is an important step on our path to becoming a leading global manufacturer of innovative drive systems. And our new three-pillar growth strategy for China means that we are now also strengthening our position in the world’s biggest engine market. For 2019, we expect a further increase in revenue and a further improvement in profitability towards our medium-term target of an EBIT margin before exceptional items of 7 to 8 per cent.”

Double-digit growth in new orders and revenue

In 2018, the DEUTZ Group received orders worth €1,952.6 million, which was an improvement of 25.4 per cent compared with the prior-year figure of €1,556.5 million. All off-highway application segments as well as the service business registered increases. Orders on hand totalled €438.9 million as at 31 December 2018, a rise of 62.0 per cent compared with the figure of €270.9 million at the end of 2017. DEUTZ generated revenue of €1,778.8 million in 2018, which was 20.3 per cent higher than the figure of €1,479.1 million achieved in 2017. DEUTZ therefore comfortably exceeded the forecast, published in its 2017 annual report and reiterated in July 2018, of a marked rise in revenue to more than €1.6 billion.

Substantial increase in operating profit

Operating profit (EBIT before exceptional items) more than doubled in 2018, going up by €42.3 million to reach €82.0 million (2017: €39.7 million). This was mainly because of the higher volume of business and the resulting economies of scale as well as positive effects from the efficiency program. It was achieved in spite of several weeks of strike action at a supplier. Most of the negative effects resulting from this disruption, which occurred in the third quarter of 2018, were compensated for by reconfiguring production plans and initiating catch-up measures. DEUTZ also withdrew from the DEUTZ Dalian joint venture last year. The negative impact on earnings attributable to the joint venture in the first half of 2018 was slightly outweighed, as had been anticipated, by the proceeds generated from the sale of the shares in the fourth quarter of 2018. The EBIT margin before exceptional items improved from 2.7 per cent in 2017 to 4.6 per cent last year. At the start of the year, DEUTZ had expected a moderate increase in the EBIT margin before exceptional items. The improvement of 1.9 percentage points in the EBIT margin more than exceeded this initial forecast as well as the more specific forecast made in July 2018 of an EBIT margin of at least 4.5 per cent.

Prior-year result inflated by positive effects from exceptional items

Net income fell by €48.6 million to €69.9 million in 2018. This resulted in earnings per share of €0.58 (2017: €0.98). When adjusted for exceptional items recorded in the prior year, which mainly related to the sale of property and totalled €85.5 million after taxes, net income rose by €36.9 million. Adjusted earnings per share thus improved from €0.27 in the prior year to €0.58 last year.

Segment: DEUTZ Compact Engines

€ million | FY 2018 | ∆ yoy | Q4 2018 | ∆ yoy |

New orders | 1,638.2 | +27.0% | 326.0 | +1.5% |

Revenue | 1,484.0 | +20.9% | 398.8 | +24.7% |

EBIT (before exceptional items) | 63.2 | +219.2% | 35.0 | +146.5% |

- Significant increase in new orders

- Double-digit revenue growth in the main application segments: Material Handling up by 41.9 per cent, Construction Equipment up by 25.8 per cent, Agricultural Machinery up by 12.9 per cent

- Substantial improvement in the EBIT margin before exceptional items to 4.3 per cent (up by 270 basis points) due to economies of scale and efficiency gains

DEUTZ Customised Solutions segment

€ million | FY 2018 | ∆ yoy | Q4 2018 | ∆ yoy |

New orders | 286.0 | +9.5% | 70.7 | +24.5% |

Revenue | 271.2 | +9.4% | 79.4 | +27.4% |

EBIT (before exceptional items) | 32.9 | +34.3% | 6.6 | +153.8% |

- Very good performance in Q4 2018 due to the high level of orders on hand

- Service revenue advances by 10.1 per cent in 2018

- EBIT margin before exceptional items rises to 12.1 per cent (up by 220 basis points) on the back of an improved product mix and efficiency gains

Consistent dividend

As in the prior year, the Board of Management and Supervisory Board of DEUTZ AG propose using €18.1 million of the accumulated income to pay a dividend of €0.15 per share. The dividend per share is therefore at the same level as in 2017. However, it has been funded exclusively from the operational business, whereas last year the intention of the dividend was to allow the shareholders to benefit from the completed property transactions. DEUTZ is aiming to maintain a dividend ratio of around 30 per cent of net income over a number of years.

Positive outlook for 2019

This year, DEUTZ’s engine business will benefit from persistently strong demand from customers. The start of 2019 has been characterised by a high level of orders on hand, which bodes very well for business in the first half of the year in particular.

For 2019 as a whole, DEUTZ expects revenue to increase to more than €1.8 billion. The EBIT margin (before exceptional items) is also forecast to improve to at least 5.0 per cent. This increase is likely to result mainly from the anticipated growth in revenue, but also from the various initiatives aimed at continuously increasing efficiency. The ongoing expansion of the service business will also help to improve overall profitability relative to 2018. DEUTZ is therefore expecting to take a further step towards its medium-term target (for 2022) of an EBIT margin before exceptional items of 7 to 8 per cent. The payment of the final instalment of the purchase consideration from the disposal of the Cologne-Deutz site could result in an exceptional item that would increase earnings by around €50 million in 2019.

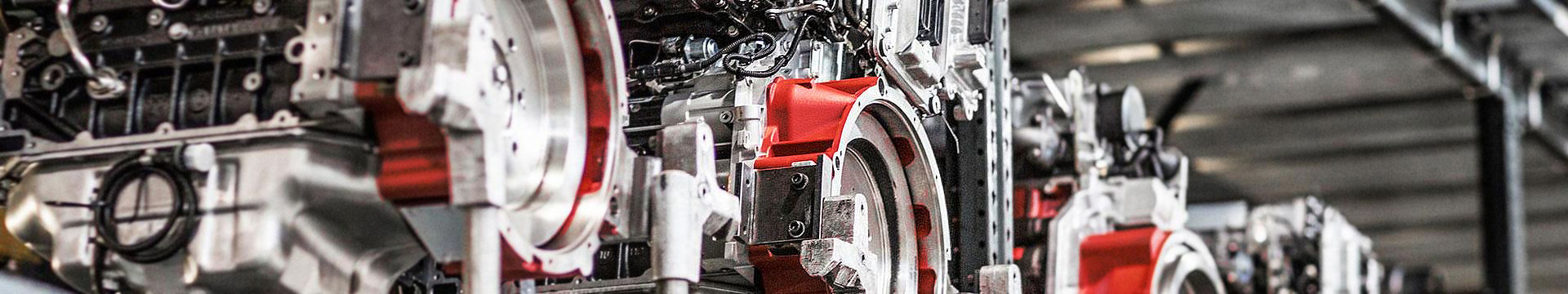

Current image files

https://www.deutz.com/en/media/media-center/photos

Upcoming dates

30 april 2019: Annual General Meeting, Cologne

Contact

DEUTZ AG / Leslie Isabelle Iltgen / Senior Vice President Communications & Investor Relations

Phone: +49 (0)221 822-3600 / E-mail: Leslie.Iltgen@deutz.com

About DEUTZ AG

DEUTZ AG, a publicly traded company headquartered in Cologne, Germany, is one of the world’s leading manufacturers of innovative drive systems. Its core competences are the development, production, distribution and servicing of diesel, gas and electric engines for professional applications. It offers a broad range of engines delivering up to 620 kW that are used in construction equipment, agricultural machinery, material handling equipment, stationary equipment, commercial vehicles, rail vehicles and other applications. DEUTZ has around 4,000 employees worldwide and over 800 sales and service partners in more than 130 countries, and in 2018 generated revenue of €1,778.8 million.

Further information is available at www.deutz.com.